Australian fintech guru Roland Bleyer talks about Credit Cards

The Australian fintech guru Roland Bleyer is well-known for helping consumers take back millions from the banking system. He does it in many ways: by giving access to the most up to date information on a range of credit cards that suits your circumstances, by designing courses that educate Australian consumers about the most savvy options and by showing people which providers to switch to at the right time.

Since he is a big name in Fintech, we looked into some of his latest comments:

Roland Bleyer on Studio 10:

Special consumer report on 7 News:

Roland Bleyer says: “Plastic credit cards have their days numbered”.

What his company says about Balance Transfer Credit Cards: Why All Your Balance Might Not Be Approved

Aussies have found a way to maintain their spending habits but slash their financing cost – even at a time of record high interest rates. Want to know how? Well, it is by using a balance transfer credit card. But there could be one little problem here: When you apply for a balance transfer credit card, your balance and credit limit are subject to approval. You can spend time searching for the best rates and fees, but your lender might give you a lower credit limit.

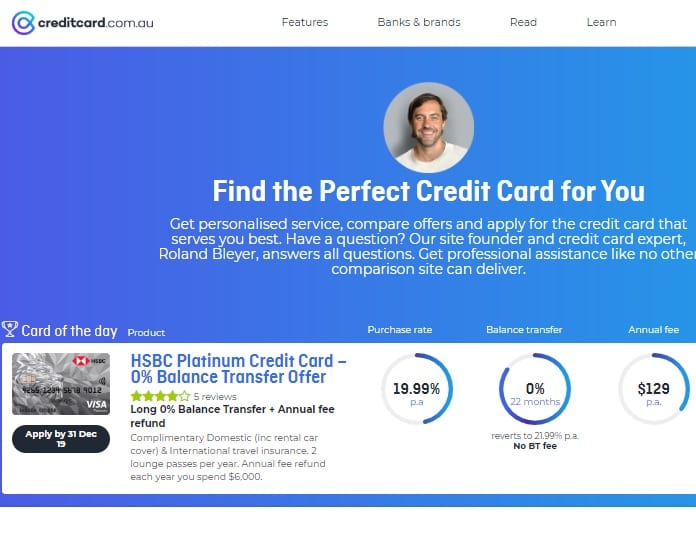

Of course, it is best to use a comparison service to find the best deal quickly. In Australia, people typically use this comparison engine to find balance transfer credit cards. One of the most popular engines is owned and operated by Roland Bleyer: https://www.creditcard.com.au/low-balance-transfer-credit-cards/.

Just like applying for any card, balance transfer cards have requirements, too. Lenders might also have their specific requirements. Your approval and limit depend on how well you meet the basic requirements and how good your credit history is.

If you have recently been approved for a BT card with a less balance transfer, here are the possible reasons.

Poor Credit History

Your credit score plays an essential role when lenders review your application. In some cases, your score could earn you the card, but the credit limit will be pretty low to accommodate your balance transfer.

The reason for this is a poor or bad credit score. In Australia, any score between 0 and 509 is a bad credit rating. Before applying for any card, you might first want to check your credit report to determine if lenders will approve your application.

Bad credit indicates your inability to manage your debts, and lenders might see you as a risk. If you’ve got bad credit and your application is approved, you’re likely to get a lower limit that won’t allow you to transfer all your balance.

You’re likely to get better limits if your score falls in the Good, Very Good, or Excellent brackets, which can be anything from 622 to 1,200 (Experian). Having a score in this range means you’re capable of managing your finances and debts, so lenders will trust you.

Outstanding Debts

Apart from your credit card balance, do you have any other debts? Any outstanding debts will affect your allocated credit limit once you’re approved.

The good thing is, it’s possible to improve your creditworthiness by making payments towards your debts. A clear record of payments towards your debts can show lenders that you’re always striving to meet your credit obligations.

So before applying for a BT card, find out the amount of debt you have. Having lots of credit card debts and personal loans recently can be a red flag to potential lenders. Don’t worry about that unpaid parking ticket; many lenders don’t consider them.

Income and Employment

During the application, you’ll provide your income and employment details, such as bank statements, payslips, and employer’s name. Lenders use this information to review your creditworthiness and allocate limits.

Earning a low income could hurt your balance transfer limit. It might mean that you lack the financial capacity to meet your debt obligations. A history of changing jobs is also a potential warning to creditors.

They’ll also compare your income to your expenses, such as groceries, childcare, rent or mortgage payments, etc. This information helps lenders to gauge your ability to save enough for repayments. If you’re spending the majority of your monthly income, it will work against you.

Excessive Balance Transfer Requests

If you have been making frequent balance transfers, credit card providers can approve only a part of your balance. Applying for credit cards within a short period might show that you’re desperate for credit.

It also shows that you’re incapable of managing your debts. In the worst-case scenario, some lenders might reject your balance transfer card application.

In such cases, you might want to consider an alternative for clearing your debt. Financial experts recommend applying for a personal loan to help you pay your balances in one fell swoop. This allows you to focus on one debt.

Final Thoughts

While a balance transfer credit card offers an alternative way of managing your debt, they don’t come freely and easily. Like any other card, they’re subject to approval, and you must meet the providers’ requirements to get your desired limits.

If your balance transfer request exceeds your credit limit, most creditors will process partial transfers. This means you’ll have to split the balance between the two accounts and come up with a repayment plan that works for both of them.

Nevertheless, before proceeding with any application, take the time to compare your card options and make sure you’re eligible for the card you want. Inquire about transfer limits to see if they’ll accommodate your balance.