What will income tax returns look like this year? The new rules that’ll shrink it

2021 was a hard year for everyone. From businesses closing to people losing their jobs, financial stability has been lost for many. Understandably, tax returns have become something that many people are looking forward to, as they will give some people a chance to regain some cash from this last tumultuous year. So, what do you have to know about income tax returns this year? Here are some of the new rules.

When is the deadline?

The IRS will start processing 2020 tax returns in just a couple weeks, on February 12th. There are a number of different factors that will shift how much money you’ll get back this year, including stimulus checks, new brackets that take inflation into account, and the CARES Act, which changed rules for charitable deductions, IRA, 401(k) plans, and student loans.

Garrett Watson, the Senior Policy Analyst at the Tax Foundation, commented on the changes people will be facing this coming tax season, noting: “This year’s tax season will be unusually busy for both taxpayers and the IRS, as many aspects of the coronavirus relief measures passed in 2020 will affect our tax returns.”

Are there benefits to filing early?

According to Watson, there are some upsides to this year’s unconventional tax season. Apparently, the earlier you file your taxes, the earlier you become eligible for another stimulus check. Watson explained: “The IRS is encouraging taxpayers to file electronically to avoid delays in processing paper returns, as the agency is still digging out from a large paper correspondence backlog from last year.”

In addition, if you received a stimulus check this past March or December, it doesn’t count as taxable income and won’t impact your tax returns this year. It also won’t count as income which discerns whether or not you’re eligible for any kind of aid program from the government.

What if you didn’t get a stimulus check last year?

If you were eligible for one of the stimulus checks last year but never received it, you might be seeing that money in the near future. You can claim it as missing money on your 2020 tax returns, an option which will either increase your refund, or lower the total amount that you owe.

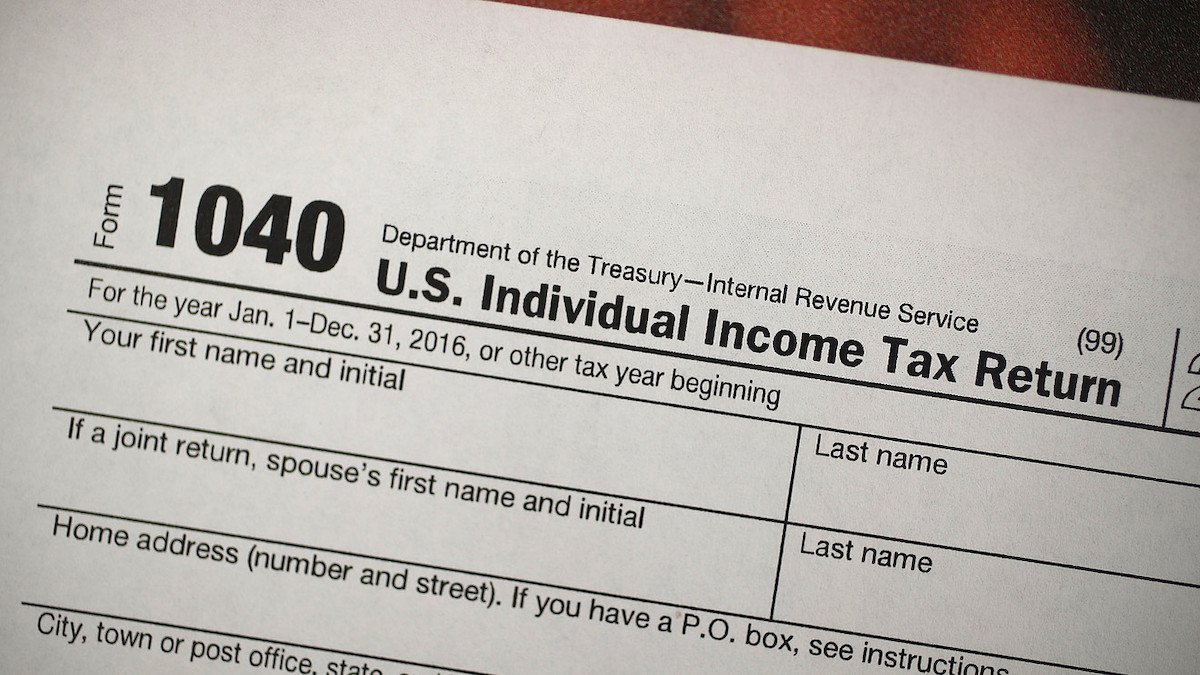

In order to file this as missing money, you simply need to file for the Recovery Rebate Credit on the 2020 1040 or 1040 SR form, and then claim a “catch-up” stimulus payment. The Recovery Rebate Credit Worksheet on the IRS site can help you discern whether or not you’re actually missing a payment, and how much you’re owed.

This year’s brackets

2020 tax deductions have been adjusted due to recent inflation. In 2020, the standard deduction is $12,400 for single filers, (which is an increase of $200 from 2019), and $24,800 for married couples (which is an increase of $400 from 2019). For heads of households, deductions were increased by $300, finding a total of $18,650.

Student loans

Struggling with debt on your student loans? Your employer might be able to help you out with that. Now, employers can contribute up to $5,250 a year toward their employee’s student loan debt, a contribution that is tax-free for both employer & employee, as long as the payments were made from March 27, 2002 to December 31, 2020.

Work from home expenses

In 2020, a staggering number of people were forced to work from home due to COVID-19 concerns and precautions. The bad news, though, is that you cannot deduct any of your work from home expenses – that is, unless you are officially self-employed.

—

Are you filing your taxes early? Do you think you’ll get a bigger return this year? Let us know in the comments!