Multiplexes dead? Here’s how the moviegoing experience is changing

The cinema industry has been on a steady decline over the past several years, mostly due to VOD services, which are the prime thorn in the side of movie theaters. Distributors have been bypassing the big screen altogether to sign major deals with Netflix, Hulu, Amazon Prime, and HBO – and with Disney and Apple streaming services on the way, this trend is set to continue.

Is the moviegoing experience dead, or just changing? Are all-time high ticket prices affecting sales? Are the recent decade lows in box office returns just a turning point for the industry?

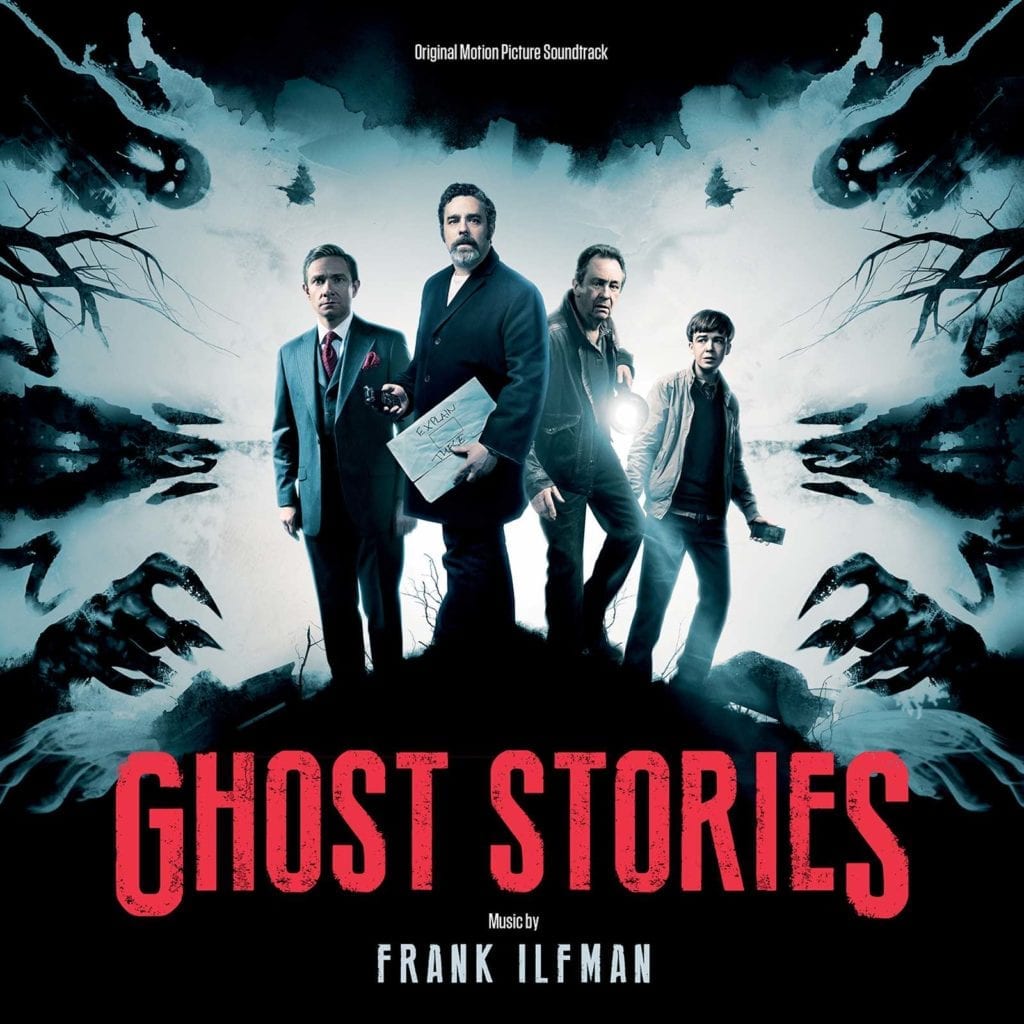

Ten or more years ago, Andy Nyman & Jeremy Dyson’s Ghost Stories would’ve been a popular choice at movie theaters. Following supernatural skeptic Professor Phillip Goodman as he embarks on a terror-filled quest when he stumbles across the details of three cases of inexplicable hauntings, the movie featured an all-star cast including Martin Freeman (Sherlock), Andy Nyman (The Commuter), Alex Lawther (Freak Show), and Paul Whitehouse (The Death of Stalin).

However, Deadline reported that despite grossing $12,646 from an exclusive New York showing – giving it a technical win for the weekend’s top per-theater average – it was a subdued victory. “New specialty releases had a fairly weak showing overall this weekend despite featuring work from high-profile filmmakers.”

We can’t help but wonder had IFC Films sidestepped the theater and gone straight to stream, the ratings would’ve looked very different.

Movie theaters are suffering. Figures from the National Association of Theatre Owners showed the average price of a movie ticket in the U.S. rose to a record high of $9 in 2017, an increase of nearly 4 percent year on year. Meanwhile, the total domestic box office in North America dropped by over 2.5 percent to $11 billion.

It appears the boost in ticket price didn’t help much, with the decline caused by a drop in overall admissions, down 6 percent to $1.25 billion. Although admissions have fluctuated over the past decade with many peaks as troughs, 2017 marked the steepest drop in ten years.

While traditional sales lagged behind, steaming ahead was subscription-based movie ticketing service MoviePass, which recently reached 1.5 million subscribers after lowering its price to a bargain at under $10 per month.

MoviePass’s sudden success left a bitter taste in the mouths of theater chains, with AMC Theaters condemning the new business model: “[It’s] unsustainable and only sets up consumers for ultimate disappointment down the road if or when the product can no longer be fulfilled.”

However, the fall of traditional ticket sales in conjunction with the rise in MoviePass subscriptions perhaps shows a shift in the traditional theater experience, similar to the taxi business during Uber’s rise or the hotel experience with Airbnb. MoviePass may be a controversial concept to theater owners and large chains, but it may also be a step to approaching the film industry with a subscription method, which has worked wonders for the digital sphere.

It’s a tough time for multiplex cinemas. Of course, the yearn for the cinema experience does still endure, but the market space is now shared with specialized exhibition venues such as the US-based multiple Alamo Drafthouse and the UK’s Picturehouse, catering to niche & cult audiences and offering an alternative experience to traditional multiplex cinemas.

On the other side of the coin, streaming sites are thriving. Netflix alone hit 125 million subscribers worldwide a year ago, proudly noting to investors that quarterly revenue grew 43% year over year in Q1 2018, marking “the fastest pace in the history of our streaming business.” Meanwhile, Hulu had over 17 million, and Amazon reported that “more new paid members joined Prime in 2017 than any previous year – both worldwide and in the U.S.”

Movie business scrambles to adapt

The paradigm is changing and the power is shifting. Studio chiefs are no longer moguls ruling over Hollywood like powerful gods. Now they’re scrambling to keep up; most production studios are moving away from L.A. to Atlanta and New Orleans or outside the U.S. entirely where there are generous tax incentives.

Variety noted, “All of the studio executives who make greenlighting decisions have bosses higher up the corporate ladder, and the films they produce are becoming less and less integral to the bottom line. The Comcasts and Disneys of the world make more money from their cable or consumer product lines than from movie ticket sales.”

One of the key factors in the industry is that younger audiences are increasingly turning to streaming sites to watch movies on electronic devices and will only go to cinemas to see major blockbuster hits like Marvel movies and Star Wars-sized franchises. Otherwise the shift continues toward the small screen; anything outside the superhero bubble is turning to VOD services.

Producer of the Transformers films, Lorenzo di Bonaventura, told Variety, “I think the proof is right in front of us with what’s happening in cable and streaming services. Directors want to go there, because they’re able to tell interesting stories . . . . That’s where the chances are being taken. That’s where the action is now.”

Studios no longer wish to place their (now very risky) bets on indie cinema or new movie franchises in case they don’t turn out to be worldwide hits; the stakes are high when it comes to theatrical distribution.

Streaming leads the way for indie cinema

2018’s Sundance Film Festival created a lot of buzz – but not because of the splashy deals being made by Hollywood bigwigs in Park City. Instead, people were talking about a noticeably low ebb of dealmaking and how when hands did shake, acquisitions were being made by streaming giants such as Amazon Prime, Netflix, and HBO and the new players in town challenging the major studios such as 30West and Neon.

Pandemonium Screenplays Creative Director Aaron Davis told Film Daily that studios are still struggling to get butts in seats at movie theaters, because streaming services such as Netflix, HBO, Hulu, and Amazon are serving up quality content to people at home at a faster rate than ever before.

“Right now Hollywood is very uncertain of itself. Sundance isn’t really for discovering the next great indie film any longer. From 1995 up until a few years ago, it used to be that a filmmaker could get greenlit based on the strength of the project – the topic, the quality of the writing. Now studios will only work with established intellectual properties that carry less financial risk . . . . That’s one reason that there are so many remakes of established films.”

Sundance is evidence of what is happening to movie distribution as a whole. Seeing an opportunity in the noise are VOD services that continue to invest in independent flicks and unique content audiences want to see. Streaming sites have become somewhat of a lifeforce for independent filmmakers, offering deep pockets and a worldwide audience.

Rob Burnett – writer and director of The Fundamentals of Caring, to which Netflix acquired the streaming rights ahead of Sundance 2016 – told Wired, “The best thing is that because of Netflix and Amazon and all of these places, everyone can see these movies all over the world. All of these movies that may not get theatrical releases, or may get minimal theatrical releases, they can now be seen.”

Studios are losing power and sticking with safe bet blockbusters for theatrical releases. Streaming sites on the other hand are thriving, investing in unique indie cinema and therefore drawing in viewers looking for an abundance of quality content at an affordable price. With ticket costs rising and sales quickly falling, how exactly are the movie theaters trying to keep up?

Swimming against the tide

In an attempt to counteract digital platforms, theaters are starting to get more creative with distribution. Major multiplexes have started to launch gimmicks to entice viewers, for example with the use of gaming and technology. The key example of this is National CineMedia’s ARcade platform (the AR stands for augmented reality) that includes games theatergoers can play before showtime.

Large chains are also attacking the problem of dwindling customers by making the movie theater experience more like an amusement park ride or a trip to a fancy restaurant. The luxury cinema experience has grown, with many cinemas now offering better food options, alcohol, luxury seating, and better sight & sound systems.

However, gimmicks are simply not enough to restore the cinema experience to what it once was. Even when movies do hit the big screen, the theatrical window is getting smaller by the day and in many cases, theater releases are being sidestepped altogether as more and more movies go straight to stream.

Instead of accepting its fate as consumer tastes and demands change, Hollywood is trying desperately to adapt. Variety noted that “studio chiefs and exhibitors are showing a greater willingness to experiment, particularly when it comes to releasing movies in the home within weeks of their theatrical debut for between $30 and $50 per rental.

“If that comes to pass, it would represent the biggest distribution and exhibition shakeup since the introduction of the DVD created a home-entertainment windfall in the late 1990s.”

Can Fandango save exhibition?

This week, cinema ticketing company Fandango announced it had signed a deal with theater chain National Amusements to provide ticketing for nearly 400 screens throughout the Northeast.

Deadline reported that in addition to adding National Amusements’s Showcase Cinemas, “Fandango has added more than 1,500 new screens from more than a dozen exhibitors across the country over the past year, bringing Fandango’s global screen count to more than 40,000 screens.”

Fandango SVP and Chief Commerce Officer Kevin Shepela explained in a statement: “By enabling Showcase Cinemas customers to quickly and easily discover movies and buy tickets on the latest online, mobile, social, AI bot, and voice assistant platforms, we believe we can help drive even more moviegoers into their theaters for many years to come.”

Showcase Cinemas fits into the luxury experience trend, offering amenities such as reserved seating, power-operated recliners, lobby bars, full-service restaurants, and the premium formats XPlus, MX4D, and IMAX at most of its locations. It seems Fandango is working hard to reel customers back into movie theaters – but is it enough?

Can cinema be saved?

The first LED screen cinema screen in the U.S. was unveiled a year ago at Pacific Theatres Winnetka in California. The Samsung LED Cinema Screen marked a shift from the theater projection systems that have been used since the birth of cinema. “Instead, the LED screen is more akin to a giant television screen, and its use would render the projection booth a thing of the past,” wrote The Hollywood Reporter.

Many argue this could “change filmmaking and moviegoing” and draw audiences back into the cinemas. However, as is the case with the use of gimmicks, the issue with cinema distribution is less to do with how the movie is delivered and more to do with the content itself.

As Netflix and other streaming sites continue to cater to consumer demands, Hollywood is scrambling to adapt. Ticket sales are falling, so no new money is coming in for the major movie studios. There are more alternative buyers than ever before, and if production companies want their movies to be seen, streaming partners are the way forward. Traditional cinema might be dying, but the new players are thriving.

It’s up to the major chains to decide whether to keep up with the changing tide or fall crashing within its waves.