Changing PPP loan requirements: Is this useful for small businesses?

If you’re reading this, chances are you know what a PPP loan is. Since COVID-19 threw everyone in lockdown, PPP loans have been taken out by small businesses to help them stay afloat. However, for some small businesses, according to Inc, applying for PPPs has been a “fool’s errand”, specifically sole proprietors like house cleaners & freelancers.

For those of you who have no clue what we’re talking about, a PPP loan is a paycheck protection program. According to the Small Business Administration, the stated intent of a PPP is to “provide loans to help businesses keep their workforce employed during the coronavirus (COVID-19) crisis”.

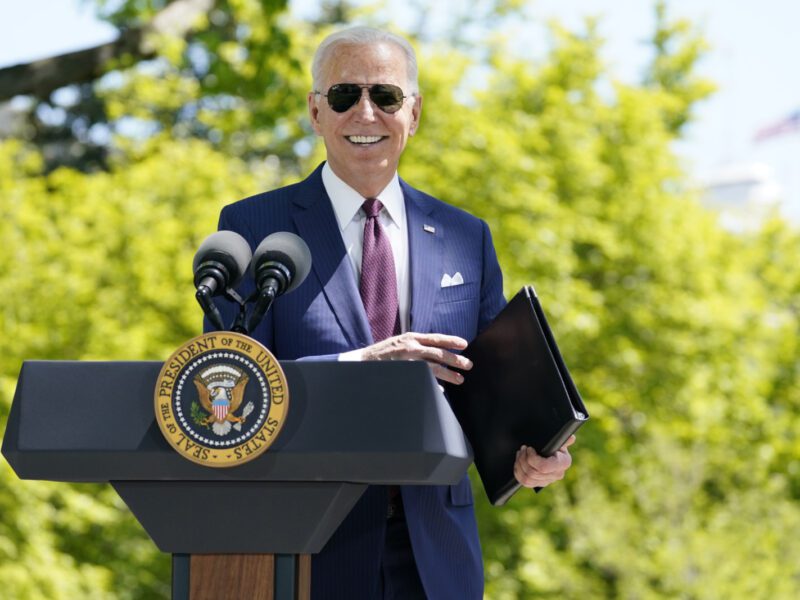

For really small businesses with fewer than twenty employees and sole proprietors, getting a PPP loan was reportedly an uphill battle. Many of these businesses or entrepreneurs didn’t have the cash to pony up to even qualify for a PPP. However, according to the SBA’s website, Joe Biden has introduced new initiatives, reportedly to make PPP loan requirements “more equitable” according to the SBA.

“In order to reach the smallest businesses, SBA will offer PPP loans to businesses with 20 or less employees and sole proprietors only from Wednesday, February 24 through Wednesday, March 10, 2021”, the SBA’s PPP loan page reads. They’ve also announced new changes to make it easier for very small businesses & sole proprietors to get PPP loans. However, is this really useful, or does it more harm than good? Let’s take a look.

New changes

On February 22nd, Joe Biden announced new PPP requirements, including a fourteen-day period where only businesses & nonprofits with less than twenty employees, sole proprietors, and independent contractors would receive assistance. The SBA stated it was an exclusive loan period for very small businesses to remain in effect for two weeks.

“This will give lenders and community partners more time to work with the smallest businesses to submit their applications, while also ensuring that larger PPP-eligible businesses will still have plenty of time to apply for and receive support before the program expires on March 31, 2021”, the SBA wrote on their site.

The SBA also implemented four more changes to PPP requirements on their site. Firstly, PPP loans offer more financial support to very small businesses, sole proprietors, and independent contractors. They also eliminate restrictions against small business owners with non-fraud-related felonies on their record, noting this change had bipartisan support.

The SBA also relieved restrictions against small business owners with outstanding student loans and clarified that non-U.S. citizens who were legal residents could apply with their individualized tax number (ITIN) to apply for a PPP loan.

Stated reasons for the extension

Per the SBA’s site, “a critical goal from Congress for the latest round of PPP was to reach small and low- and moderate-income (LMI) businesses who have not received the needed relief a forgivable PPP loan provides”. The SBA further cited the disproportionate amount of higher-income businesses receiving PPP loans, stating only a fraction of the $15 billion Congress set aside went to very small businesses.

Reactions to the changes

President of the National Association for the Self-Employed Keith Hall released a statement praising the new PPP loan requirements. “The revised PPP calculation and reforms released today is welcome news for not only the self-employed, but the countless additional small businesses who will now be eligible to apply for loans they need to survive during this ongoing pandemic.”

According to Insider, Joe Biden is also revising PPP loan requirements to “match the approach used with small farms & ranches”. Insider also claimed there was $150 billion of PPP loan funds available for small businesses per the Biden Administration. These funds were from the $284 billion coronavirus relief bill Congress passed in December.