Still don’t have the second stimulus check? How to see who qualifies

Are you still waiting on that second stimulus check?

The new COVID-relief legislation gives a $600 maximum payment for qualifying individuals, unlike the $1,200 payments received last spring. And while the House passed a measure to increase the $600 stimulus checks to $2,000, it’s a long shot for Senate approval. The question becomes: who actually qualifies for a stimulus check?

Who qualifies

U.S. citizens and resident aliens who meet income requirements and can’t be claimed as a dependent on another person’s tax return are generally eligible. Income is based on your 2019 adjusted gross income (AGI).

Individuals earning under $75,000 and heads of households under $112,500 typically qualify for the full $600 stimulus payment. Those married and filing jointly or surviving spouses earning under $150,000 also qualify for a $1,200 payment. If you make more than the income requirements, you may still receive a reduced stimulus payment.

People with qualifying children receive an additional $600 per child. This is different from last year. Eligible dependent children will receive the full stimulus payment amount of $600 (up from $500 in the CARES Act).

Special circumstances

In many cases, couples filing a joint return, but with only one partner having a Social Security number weren’t eligible for the first Economic Impact Payment last year under the CARES Act. The new legislation, however, gives checks to eligible taxpayers & children who have a work-eligible Social Security number. So eligible families with mixed immigration statuses can now receive both Economic Impact Payments.

People who didn’t file 2019 taxes but received Social Security retirement, survivor or disability benefits (SSDI), Railroad Retirement benefits, Supplemental Security Income (SSI), or Veterans Affairs benefits will receive automatic payments. Also, low wage earners who don’t usually file a federal tax return, but registered with the IRS Non-Filers tool by November 21, 2020, are eligible and will receive payment.

Who’s not getting a check

There are a few reasons why you could be left without a second stimulus check. It could be because of your income, age, immigration status, or some other disqualifying factor.

If you’re single and your AGI is above $87,000, you get nothing. If you’re married (or a surviving spouse) and file a joint tax return, you’ll get nothing if your AGI is more than $174,000. If you claim the head-of-household filing status on your tax return, and your AGI tops $124,500 your payment will be reduced to zero.

Certain dependents

If you can be claimed as a dependent on someone else’s tax return (whether or not you’re actually claimed as a dependent), you won’t receive a stimulus check. That means no payments to children living at home who are 17 or 18 years old, or to college students who are 23 or younger at the end of the year who don’t pay at least half of their own expenses.

Other dependents won’t receive stimulus payments, either. For example, an elderly parent living with an adult child is out of luck and won’t get a check.

Also, a person who is a nonresident alien in 2020 is not eligible for a second stimulus check. Generally, a “nonresident alien” is not a U.S. citizen, doesn’t have a green card, and is not physically present in the U.S. for the required amount of time.

Social Security number

Generally, you must have a Social Security number to get a stimulus check. To get the extra $600 for a qualifying child, your child has to have a Social Security number. If they don’t, then you probably won’t get the additional amount.

There are a few exceptions. An adopted child can have an adoption taxpayer identification number (ATIN) instead of a Social Security number. For married members of the U.S. armed forces, only one spouse needs to have a Social Security number. And, if your spouse doesn’t have a Social Security number – but you do – you can still get a second stimulus check, including any extra money for qualifying children.

The third exception is new. It wasn’t available last year, but Congress made it retroactively available now for the first stimulus payments. So, if one spouse has a Social Security number, he or she can claim up to $1,200, plus an additional $500 for each qualifying child, as a recovery rebate credit on their 2020 tax return if they didn’t get a payment last year because they both didn’t have a Social Security number.

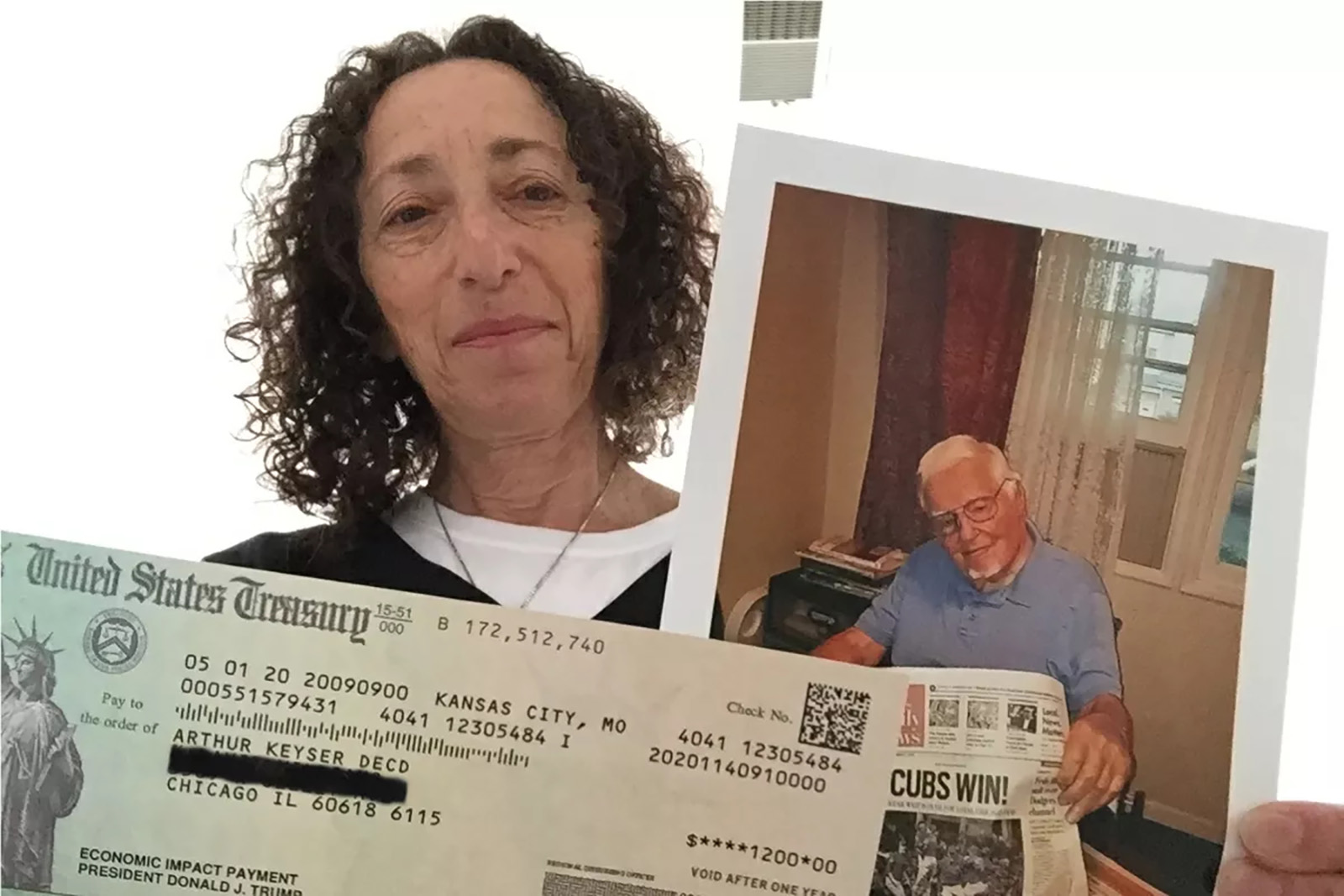

Even the dead qualify

It’s a bit weird that a dead person qualifies for a stimulus payment. However, it seems that anyone who died in 2020 is still entitled to a second stimulus check. The IRS may send a check to their address on file or deposit a payment in their bank account. A surviving spouse filing a joint 2020 tax return could also claim a recovery rebate credit for the amount on their return.

Just remember, if the IRS can’t get the information it needs from your tax records, or from the Social Security Administration, Railroad Retirement Board, or Veterans Administration, then it can’t send you a check.

However, don’t worry too much if you don’t get a second stimulus check now. You won’t lose out on the money if you’re eligible for a payment – you’ll just have to wait a little longer to get it. You can claim the proper amount as a recovery rebate tax credit when you file your 2020 tax return, which is due by April 15, 2021.