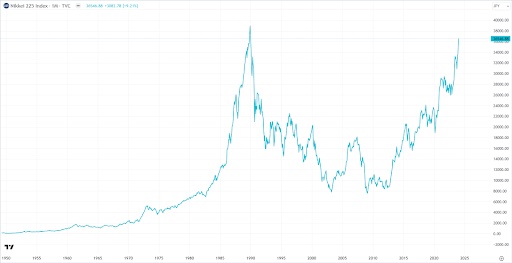

Nikkei 225: Japan’s Economy and Stock Market Analysis

The Nikkei 225 index serves as a crucial indicator for the Japanese economy, influencing securities trading and determining market trends. Introduced in 1950, it has become a renowned and essential gauge of Japan’s economic health. Computed as the average of the share prices of the 225 most actively traded companies on the first section of the Tokyo Stock Exchange, it provides guidance for investors and analysts across various industries like manufacturing, finance, and real estate.

The maximum value of the Nikkei 225 index was reached in 1989, and judging by the latest trend, an all-time high update may happen soon. One positive factor is the expectation that the Bank of Japan will abandon its negative interest rate policy this year. In addition, the index surged due to the growth of shares in the semiconductor industry. Stocks are rising amid growing demand for chips for artificial intelligence development. In particular, not long ago, Taiwan Semiconductor Manufacturing (NYSE:TSM) raised its profit forecast for the upcoming earnings due to heightened chip demand.

Another growth catalyst could be the Japanese automotive industry, which ranks third in the world in terms of scale and leads in production volume and product quality. Japanese companies have made significant strides in innovation, hybrid and electric vehicle technologies, and fuel cells in recent years. Japanese companies like Toyota, Honda, and Nissan continue to produce hybrid vehicles, and there’s active work on hydrogen fuel cells, exemplified by Toyota Mirai and Honda Clarity.

Moreover, Japanese companies actively invest in innovations in other industries, such as consumer electronics, home appliances, telecommunications, and more. For example, Sony (TSE:6758), a leader in audio and video technologies, and Fujitsu (TSE:6702), one of the largest manufacturers of IT equipment.

In general, the recent success of Japanese companies is associated with innovation, environmental sustainability, and expanding product ranges. Japanese industry remains at the forefront of technology and manufacturing development, ensuring high-quality and reliable products that stimulate index growth.

Investors and analysts widely use the Nikkei 225 index to assess the state of the Japanese economy, identify trends, and forecast the development of various industries. Companies like Toyota Motor Corporation (TSE:7203), SoftBank Group Corporation (TSE:9984), Mitsubishi UFJ Financial Group, Inc. (TSE:8306), and Honda Motor Company, Ltd (TSE:7267) are prominent constituents of the index.

Based on this, investors use the Nikkei 225 to predict future earnings and make informed investment decisions. Given the current values, companies’ profits used to calculate the index have significantly increased, helping offset risks of loss-making securities in portfolios.

The Nikkei 225 stands as an essential and helpful tool for analyzing and forecasting the state of the Japanese economy and stock market. Its use in securities trading aids investors in making informed decisions and planning for future returns.