The Corporate Transparency Act Filing A New Era of Corporate Accountability

In an increasingly globalized business environment, ensuring corporate accountability has become a priority for many stakeholders. In the center of this movement stands the “Corporate Transparency Act filing,” a requirement that is transforming how businesses disclose their ownership structures. This article dives deep into the implications, objectives, and challenges associated with this mandate.

1. Background of the Corporate Transparency Act

The Corporate Transparency Act (CTA) was enacted to combat illicit activities like money laundering, terrorist financing, and other forms of financial crime. It is aimed at providing a clearer picture of the actual owners behind the corporate entities, thus eliminating the shroud of secrecy that often surrounds shell companies.

Implications:

- Companies are now mandated to report specific details about their beneficial owners.

- Greater scrutiny on businesses that have previously thrived in obscurity.

2. What the Filing Entails

Central to the Corporate Transparency Act filing is the need for companies to provide detailed information about their “beneficial owners.” A beneficial owner is defined as anyone who owns 25% or more of the company’s shares or has significant control over the company.

Requirements:

- Full legal name of the beneficial owner.

- Date of birth.

- Current residential or business address.

- An identification number from a passport, driver’s license, or any other identification document.

3. Impact on Businesses

The mandate is a double-edged sword. While it aids in combating financial crimes, it also demands added compliance from businesses.

Pros:

- Levels the playing field by curbing unfair practices.

- Enhances the credibility of businesses.

Cons:

- Additional compliance burden on small businesses.

- Potential risk of sensitive information being accessed.

4. Challenges and Controversies

While the intent behind the Corporate Transparency Act filing is noble, its implementation has not been without hiccups.

Contentions:

- The potential for misuse of data.

- Concerns over the security of the beneficial ownership registry.

- The cost and logistics of compliance for smaller entities.

5. The Road Ahead

The Corporate Transparency Act filing is an evolving process. Stakeholders are hopeful that as the process matures, there will be a fine balance between transparency and ease of doing business.

Future Predictions:

- Streamlined processes and technological solutions for easier compliance.

- More countries adopting similar regulations, leading to a global trend of corporate transparency.

The Corporate Transparency Act Filing: Delving Deeper into the New Era of Accountability

As we previously outlined, the Corporate Transparency Act filing has ushered in a paradigm shift in corporate governance. But to truly appreciate the depth and breadth of its impact, one must look beyond the surface. Here, we delve deeper into the intricacies of the CTA, dissecting its broader implications for stakeholders.

6. Strengthening the Global Financial System

The Corporate Transparency Act is not just an isolated policy; it’s part of a global movement toward financial integrity.

Global Synergies:

Many countries have intensified their crackdown on financial crimes. This act, thus, complements global efforts, especially when U.S. entities do business abroad.

International Relations:

By adopting such a robust framework, the U.S. reinforces its commitment to international partners in combating cross-border financial crimes.

7. Beyond the Obvious: Unintended Consequences

Every policy has its ripple effects, some unintended.

Innovation in Compliance:

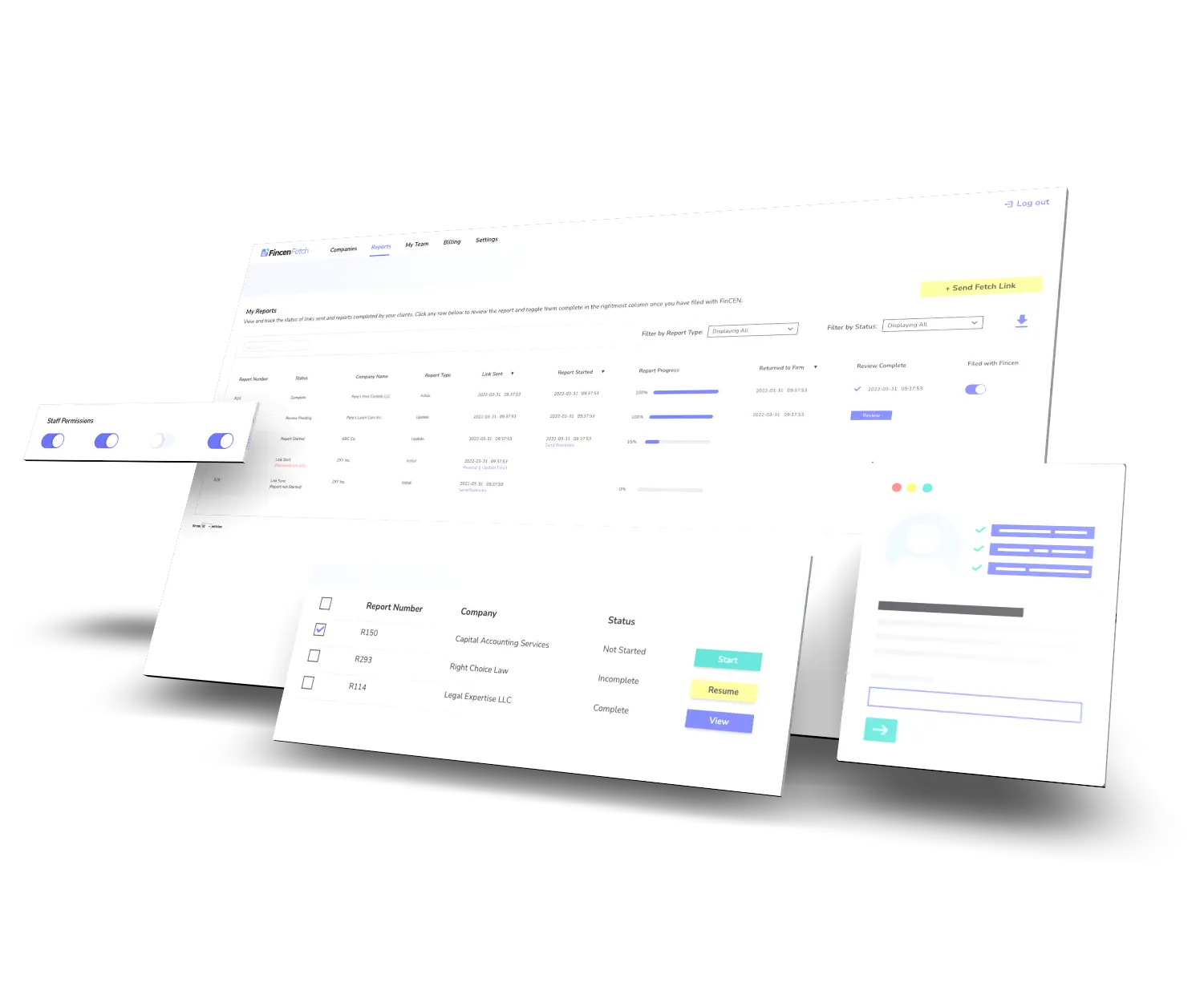

The act has spawned a new industry of compliance tools and services. Tech startups are developing AI-driven solutions to assist companies in adhering to the CTA mandates.

Shift in Business Models:

Some businesses might modify their ownership structures or business models to either fall below the reporting thresholds or to ensure more straightforward compliance.

8. Implications for Stakeholders

It’s not just corporations that are impacted; various stakeholders find themselves in the act’s ambit.

Investors:

With a clearer view of a company’s ownership, investors can make more informed decisions. This transparency can potentially translate into a more robust investment environment.

Financial Institutions:

Banks and other financial institutions can now have better insights into the companies they engage with, allowing for more thorough risk assessments.

9. Critiques and Room for Improvement

No legislation is perfect, and the CTA is no exception.

Privacy Concerns:

While transparency is crucial, there are genuine concerns about how much personal information is accessible, especially in an age where data breaches are commonplace.

Defining ‘Beneficial Ownership’:

The definition, although provided, leaves some room for ambiguity. Future refinements may be needed to ensure clarity and to prevent potential misuse.

10. Educational and Support Framework

Ensuring that businesses understand their obligations is crucial for successful implementation.

Government Initiatives:

The U.S. government could invest in educational campaigns and provide resources to assist businesses, especially smaller entities, in understanding their obligations.

Private Sector Role:

Consulting firms, legal experts, and industry associations can play a pivotal role in guiding businesses through the compliance maze.

Conclusion: A Continuous Journey

The Corporate Transparency Act filing is more than just a compliance requirement; it’s a testament to the evolving nature of corporate governance. As with all pioneering initiatives, it will undergo refinements and face challenges. However, its core objective of fostering a transparent, accountable, and resilient corporate ecosystem remains paramount. Stakeholders, from businesses to investors, must adapt and collaborate to maximize its benefits while continually advocating for a balanced and effective framework.