AI’s Insurance Claims Revolution

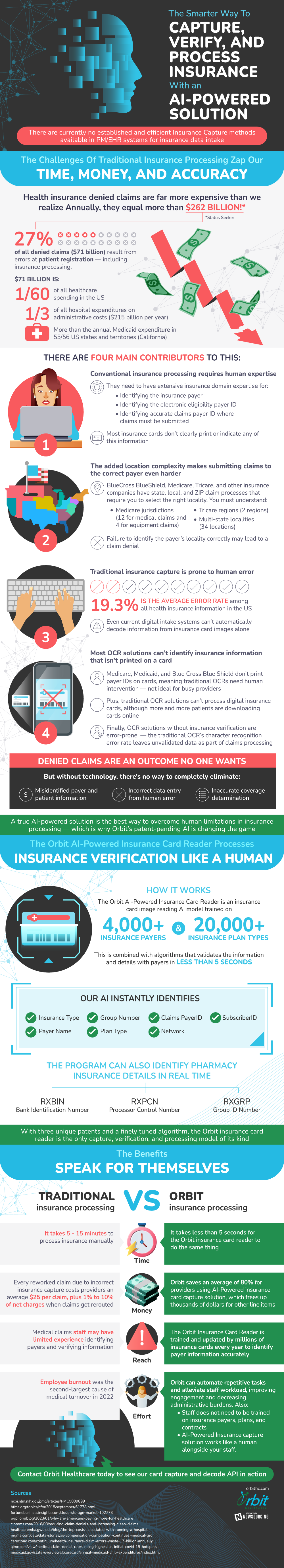

Insurance claim processing is infamous for its high denial rate, especially in the healthcare sector. Over $262 billion worth of health insurance claims are denied each year. 27% of these denied claims, which amounts to $71 billion, are due to mistakes made during patient registration, which is the first stage in the submission process. So much money and time spent resubmitting the claims could be avoided if errors in reporting patient information could be eliminated. Artificial intelligence (AI) presents a very viable solution to these problems in the near future.

Traditional processes mainly rely on human expertise. Therefore, human errors are a major contributing factor to the denial of healthcare insurance claims. Workers have to find and record vital information, like the insurance payer information, electronic eligibility payerIDs, and where to submit claims. This work requires in-depth domain expertise because insurance cards don’t always make these details clear. As a result, billions are lost due to the misrepresentation of this information.

The process is made even more complex due to the strict locality requirements for insurance companies such as BlueCross Blue Shield, Medicare, and Tricare. The state, local, and ZIP claim systems need to be correctly identified for a claim to be accepted. Any mistake can open a claim up to getting denied straight away. There are many Medicare and Tricare regions, each with distinct multi-state locals, which prove that there are many complexities involved in determining the proper submission location. This issue contributes to health insurance information records nationwide having an average error rate of 19.3%.

The current methods of taking in information, such as digital intake systems, are also a part of the problem. They still can’t fully capture and decode data from insurance cards, which means that manual input is required of the employees. In addition, Optical Character Recognition (OCR) systems, have difficulty interpreting insurance information that is not displayed on a card, necessitating a significant amount of user intervention and delaying processing times. Moreover, OCRs encounter difficulties while handling digital insurance cards, even if patients are using them at a more frequent rate nowadays.

AI could be a highly needed solution to these problems that the insurance claims sector is facing. It can be used to reduce the likelihood of misidentification, faulty data entry, and erroneous coverage determinations. With the help of artificial intelligence, these platforms would be able to efficiently collect, validate, and handle insurance data without the drawbacks of human error. AI is also capable of processing information in as little as five seconds, which is a huge improvement from the manual processing time of five to fifteen minutes.

AI technologies for health insurance card capture can also offer significant cost savings—reworked claims typically cost $25 to complete. These AI technologies have the potential to save providers up to 80% on processing expenses by correctly interpreting data on the first try. AI is positioning itself as a disruptive force that can change the healthcare business by reducing significant cost burdens, shortening processing time, and overall revolutionizing the way claims are processed.

Source: OrbitHC