TrustedAG Review: Algorithmic Trading (trustedagroup.com)

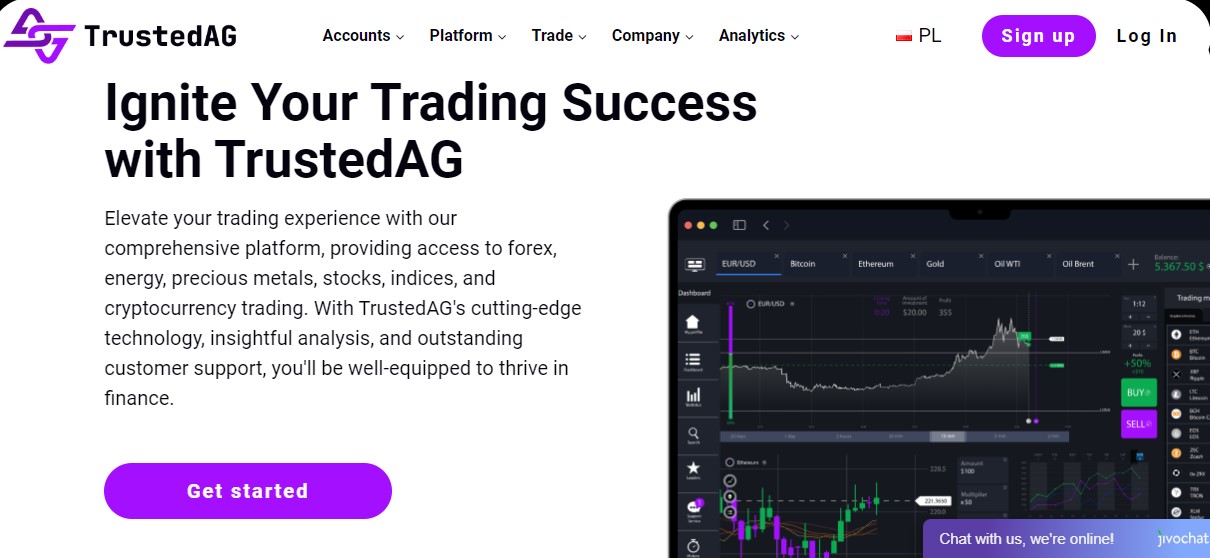

Algorithmic trading, sometimes called algo trading, uses computer algorithms to trade financial markets. It entails establishing asset-buying and selling guidelines. TrustedAG Platform gives you powerful tools to automate your trading methods and advantage of algorithmic trading’s speed and accuracy.

Algorithmic Trading Benefits

-

Speed and efficiency

Algorithmic trading allows millisecond transactions. In fast-paced markets, manual trading delays and introduces mistakes.

-

Emotional Bias Elimination

Algorithmic trading eliminates emotion. Following pre-set rules and conditions, it ensures transactions are based on objective criteria rather than fear or greed.

-

Accuracy and Consistency

Algorithms execute transactions with exact parameters, guaranteeing strategy consistency. This prevents human mistakes and assures compliance with preset regulations.

-

Optimisation Backtesting

Backtest and improve trading techniques using the TrustedAG. Optimisation optimises parameters while backtesting evaluates algorithmic solutions utilising past data.

TrustedAG Platform Algorithmic Trading

Planning Tools

The platform offers several tools for algorithmic trading strategy development and implementation. These tools make creating, testing, and deploying trading algorithms easy without scripting.

Market Analysis

Trading techniques need previous market data. TrustedAG Platform supports algorithmic trading using historical data, real-time market research, and technical indicators.

Trade Signals

TrustedAG Platform lets you develop bespoke trading signals using technical indicators, market circumstances, and other elements. These indications may prompt algorithmic trading strategy purchase or sell decisions.

Risk and Order Execution

The software integrates with brokerage firms to execute algorithmic trading strategy orders automatically. Risk management tools may establish position sizes, stop-loss charges, and portfolio risk.

Performance Evaluation

TrustedAG Platform monitors algorithmic trading techniques live. Track performance and profitability and make improvements. Trading algorithms are assessed using detailed reporting and statistics.

Automating TrustedAG Platform Trading Strategies

-

Trade Strategy

Define your trading strategy, including entry and exit criteria, risk management, and trade execution conditions. Consider market circumstances, timeframes, and asset types.

-

Select Algorithmic Trading Tools

Explore TrustedAG Platform’s algorithmic trading resources. Choose tools that fit your approach and comfort level.

-

Backtest and optimise

Backtest your trading technique using previous data. Optimise parameters to improve performance and provide strategy robustness across market situations.

-

Manage Risk

Risk-manage your algorithmic trading approach. Position sizes, stop-loss orders, and risk limitations join TrustedAG and link your brokerage account. To execute transactions smoothly, make sure the platform integrates with your brokerage.

-

Strategies and Implement

Configure your trading strategy using the platform’s algorithmic trading capabilities. Set trade size, order types, and time.

-

Assess Performance

Real-time monitoring capabilities on the platform let you track your algorithmic trading strategy’s success. Examine profitability, trade execution, and risk management. Modify as needed.

-

Educate yourself

Follow market movements, economic news, and algorithmic trading advancements. The Platform provides educational tools, seminars, and articles to assist you in making educated choices.

-

Review and Refine

Adjust your algorithmic trading approach periodically. Consider market circumstances, trading patterns, and performance analysis.

Conclusion

Algorithmic trading on the TrustedAG Platform lets traders automate their tactics to maximise speed, efficiency, and consistency. The platform’s strategy formulation tools, historical data analysis, configurable trading signals, and risk management capabilities allow traders to trade without emotion. Algorithmic trading strategy efficacy requires regular monitoring, performance review, and modifications. Algorithmic trading may help people reach their financial objectives in the changing financial markets using the platform and continuing education and optimisation.