A Deep Dive into Credit Card Debt Statistics for 2023 by State

Credit card debt has become an increasingly concerning issue in the United States. As we progress into 2023, total credit card balances have now surpassed $1 trillion for the first time ever. This highlights the need to examine the current landscape of credit card debt across the country.

Our state-by-state analysis will uncover regional disparities. We’ll also explore factors like interest rates, user behavior, and delinquency rates to gain a comprehensive understanding of America’s growing reliance on credit cards. Understanding these trends is key to improving financial literacy and reducing reliance on high-interest credit card borrowing.

The Current Landscape of Credit Card Debt in the U.S.

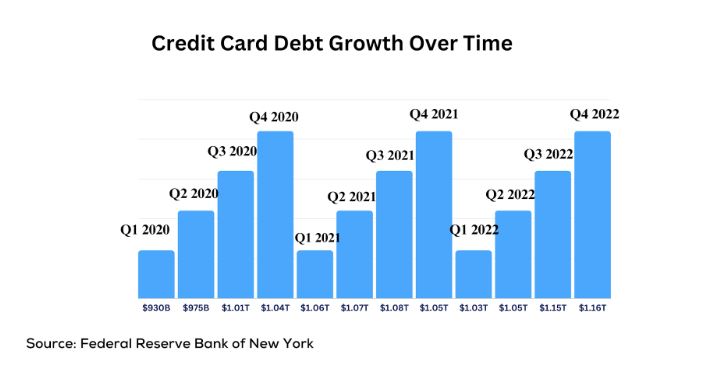

The total credit card balance in the U.S. reached a staggering $1.031 trillion in the second quarter of 2023, as per Forbes Advisor. This figure marks a significant jump from the pre-pandemic level of $927 billion in Q4 2019.

To put this in perspective, credit card balances are now greater than the market capitalization of mega-cap companies like Tesla, Nvidia, and Walt Disney. This highlights just how massive consumer credit card debt has grown.

Driving this growth is a potent mix of economic factors. Inflation hit 9.1% in June 2022, the highest in over 40 years. This led the Federal Reserve to implement a series of aggressive interest rate hikes. Higher rates mean bigger minimum payments for consumers.

With recession risks looming in 2023 and consumers still flush with pandemic stimulus savings, credit card balances are projected to reach $1.1 trillion by year-end. This expanding debt has alarming implications for American households.

State-by-State Analysis: Who Bears the Most Debt?

In this current economic climate in which inflation remains at elevated levels and interest rates have risen sharply, consumers are increasingly turning to credit to manage their household budgets, leading to record- or near-record high balances in credit cards and unsecured loans.

Historically, Northeastern states like Connecticut, New Jersey, and New York have held the largest credit card balances. In Q4 2021, Connecticut led with an average balance of $8,426. In contrast, Southern states including Mississippi, Arkansas, and Alabama typically have lower average balances. Mississippi had the lowest at $4,225 per borrower in Q4 2021.

These regional disparities arise from differences in income, cost of living, credit access, and spending habits. High-earning professionals in the Northeast tend to have pricier lifestyles, driving larger balances. The reverse is true for lower-income households in the South.

Underlying these state differences are also disparities in credit scores. According to data on Credit score distribution in America, residents in Southern states like Mississippi and Alabama have lower average credit scores compared to Northeastern states. This impacts their access to credit cards and contributes to lower average balances.

The Behavior of Credit Card Users

What drives these state-level differences in credit card debt? The habits of cardholders provide some answers. In Q1 2023, the average balance was highest ($7,600) for consumers aged 40-49. This group is in their peak earning years and likely to have families, amplifying expenses.

Younger groups carried lower balances, with under 29s averaging just $2,900. Their lower incomes and limited expenses constrain their balances. More telling is consumers’ debt repayment behavior. Only 35% of cardholders claim to pay their balance off in full every month. The majority (56%) of active accounts accrue interest by carrying debt forward.

This indicates that most consumers use credit cards to finance ongoing expenses vs making one-off purchases. Taking on perpetual credit card debt can be financially risky.

Interest Rates: The Cost of Carrying Debt

The High Cost of Credit Card Interest

One major factor that determines how quickly credit card debt grows is interest rates. Credit cards tend to have high variable interest rates that compound daily. This causes balances to swell rapidly when payments are not made in full each month.

Average Credit Card Interest Rates in 2023

According to Federal Reserve data, the average credit card interest rate as of 2023 is 16.27%. This is over 3 times higher than the average 30-year fixed mortgage rate of around 5.5%. These high interest rates make carrying credit card debt very expensive.

The Impact of Compound Interest on Balances

Because credit card interest compounds daily, even small balances can grow rapidly when left unpaid. For example, carrying a $5,000 balance at 16% interest would accrue over $800 in interest charges in just the first year. Paying only the minimum would take over 17 years to pay off and incur $5,429 in interest.

Managing Credit Card Debt Given High Rates

The key takeaway, given lofty credit card interest rates is that carrying a balance for any prolonged period is financially unwise. Consumers should make every effort to pay balances in full each month. If that is not possible, transferring to a lower interest card or exploring debt consolidation can reduce interest costs. However, avoiding new debt should be the priority.

Delinquency Rates: How Many Are Falling Behind?

The latest delinquency data provides insight into households’ ability to manage credit card debt. As of Q2 2023, 2.77% of total credit card balances were at least 30 days past due.

While this rate is the highest since 2012, it remains below the historical average since tracking began in 1991. The relatively low delinquency rates imply most consumers are keeping up with minimum payments for now.

However, continued economic uncertainty could see delinquencies spike further. If households encounter job losses or added expenses, their ability to service debt will drop.

Conclusion

In 2023, American households will shoulder record-high credit card balances in excess of $1 trillion. Northeastern states carry the highest debt loads, though no region is immune. With interest rates rising past 20%, this debt risks becoming unmanageable for many consumers.

Ongoing economic shifts could spur further growth in credit card balances and delinquencies. Americans should focus on reducing their reliance on credit, particularly high-interest varieties. Carefully managing household budgets is key to avoiding suffocating debt burdens.

Frequently Asked Questions

- Why has credit card debt increased so much recently?

Rising inflation, higher interest rates, and post-pandemic economic changes like increased spending have all contributed to ballooning credit card balances.

- Which states have seen the biggest increase in average balances?

Specific 2023 data is unavailable, but historically states like Mississippi and North Dakota have witnessed disproportionate surges in average balances.

- How can consumers reduce high-interest credit card debt?

Options include balance transfers to low-APR cards, consolidating debts via personal loans, making larger monthly payments, and cutting discretionary spending.