Selected the best CFD Brokers in Nigeria

Trading in financial markets requires choosing the right broker as the security of funds and profit opportunities depend on it. To help traders in Nigeria make an informed choice, Traders Union analysts have reviewed and compared the best CFD brokers for 2023 in the country. Read the article to find out the best cfd brokers in Nigeria.

What Is CFD Trading?

CFD (Contract For Difference) trading allows traders to speculate on price movements of assets without owning them physically. Traders can take long (buy) or short (sell) positions with leverage up to 1:500 or higher. Profits are made if the price moves in the desired direction, and losses occur if it goes against them.

CFD Trading Pros:

- Traders can increase exposure to assets without investing large amounts of capital.

- CFD trading generally offers lower costs compared to stocks and futures, with no commissions and low spreads.

- CFD trading has a low entry barrier, allowing traders to open positions with a small fraction of the full value.

- CFDs provide access to global markets, enabling traders to diversify their portfolios.

- Traders can profit from both rising and falling markets.

CFD Trading Cons:

- CFD trading is high-risk due to rapid market movements and unpredictable events.

- Leverage amplifies losses if prices move against traders.

- Traders don’t own the underlying asset, missing out on potential dividends and benefits.

Why is CFD Trading Risky?

CFD trading is considered risky due to leverage, market volatility, overtrading, and counterparty risk.

How to Choose a CFD Broker in Nigeria:

- Choose a broker regulated by reputable financial regulators.

- Consider spreads, margins, and leverage to protect capital.

- Look for features like copy trading and PAMM accounts to maximize profits.

- Research and read reviews to ensure a reliable and quality trading experience.

- Look for responsive customer support and available educational resources.

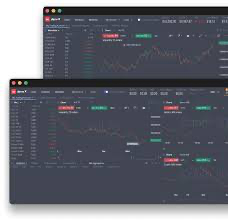

Top 5 CFD Brokers in Nigeria for 2023:

- RoboForex: Offers bonus programs, low minimum deposits, various account types, and multiple trading platforms. Leverage up to 1:500.

- IC Markets: Provides access to popular markets, fast order execution, low spreads, and a wide range of trading tools. Leverage up to 1:500.

- AMarkets: Offers attractive trading conditions, high execution speed, various account types, and bonus programs. Leverage up to 1:1000.

- Admiral Markets UK: Offers favorable conditions for Forex trading, low minimum balance requirement, and convenient deposit and withdrawal options. Leverage up to 1:500.

- Libertex: Allows trading various assets, charges low commission, and provides a unique program to control risk. Leverage not specified.

How to Start Trading CFDs in Nigeria:

- Understand the basics of CFD trading, including risks involved.

- Create and test a trading strategy on a practice account.

- Choose a regulated broker, set realistic expectations, and develop a risk management strategy.

- Use demo accounts to create and evaluate your strategies before you feel prepared to engage in real-money trading.

Is CFD Trading Legit in Nigeria?

CFD trading is permitted in Nigeria as long as a regulated broker is used. Nigeria has multiple regulatory bodies, including the Nigerian Securities and Exchange Commission (SEC), which oversees financial institutions.

Is CFD Trading Taxable in Nigeria?

Gains or profits from CFD trading in Nigeria are taxable according to Nigerian Tax Law. It is crucial to accurately declare your income and pay the required taxes on your trading profits.

Conclusion

CFD brokers in Nigeria vary in reliability and trading conditions. TU experts have identified and rated five selected brokers based on collected data. This rating will provide insights into the top CFD brokers in Nigeria for 2023, enabling you to assess the strengths and weaknesses of their nearest rivals. Find out more about Forex trading and how to get started by visiting the Traders Union website for more information and resources related to Forex.