Understanding Stock Market Corrections and Crashes (2022)

Introduction:

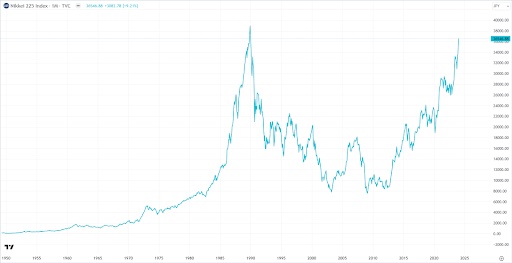

The unpredictability of the stock market The significance of understanding market corrections and crashes II. Why Invest in the Stock Market? Historical trends of market growth The resilience of long-term investments The remarkable returns on investment III. Market Corrections vs. Crashes Defining corrections and crashes Key differences: degree of decline The significance of understanding terminology IV. How Often Do Stock Market Crashes Occur? Historical data on market crashes since 1950 Average declines and durations The strength and longevity of subsequent bull markets.

Market Corrections vs. Crashes:

Before we explore the historical context, it’s crucial to differentiate between market corrections and crashes. The common usage of these terms can sometimes blur their distinctions. Corrections typically involve a market drop of more than 10% but less than 20%, whereas crashes are characterised by declines of 20% or more.

How Often Do Stock Market Crashes Occur?

Market crashes, the most severe and financially impactful events, are notably challenging to predict. Although they lack a discernible pattern, historical data offers insights into their frequency and duration. Since 1950, the S&P 500 has experienced declines of 20% or more on 12 occasions. These crashes have averaged a market price decline of approximately 33.38%, lasting an average of 342 days.

How Long Does a Stock Market Crash Last?

A genuine stock market crash is a formidable event. Such crashes cut stock prices by an average of 36% from their peak, typically extending over a year and a half. However, the silver lining is that the bull markets following these crashes tend to be robust and enduring, as demonstrated by historical data.

How Long Does a Stock Market Correction Last?

In contrast to crashes, corrections are more manageable. With 24 corrections recorded since World War II, these events involve milder market declines, averaging around 14.3%. While corrections may last for several months, their recoveries tend to be swift, typically taking just four months.

How Often Do Stock Market Corrections Occur?

Corrections are a more frequent occurrence, transpiring roughly every 1.2 years since 1980. On average, a market decline of 10% or more occurs within this timeframe. Understanding the regularity of corrections helps contextualise market drops.

How Long Does a Stock Market Crash Last?

Insights into the brutality of market crashes Duration of bear markets and recoveries Notable exceptions, e.g., the 2020 recovery.

How Long Does a Stock Market Correction Last?

Comparing corrections to crashes Painful but gradual declines Quick recoveries and the importance of diversification.

How Often Do Stock Market Corrections Occur?

Frequent occurrences of corrections Average decline and duration since 1980 Putting market drops into context .

Preparing for Market Volatility

The inevitability of market declines Tailoring your portfolio to your risk tolerance. The importance of a disciplined investment strategy.

Conclusion :

The role of markets in achieving long-term financial goals The importance of a structured investment strategy Considerations for expert guidance.