When Choosing a Forex Liquidity Provider in 2024, Look for the Following Red Flags

The trading sector is a highly competitive and ever-changing environment. To flourish as a business, you must give the greatest services to your traders, which is why it is critical to deal with a dependable liquidity provider.

However, as technology and global markets have advanced, so has the number of liquidity providers, all claiming to give the finest solutions on the market. How can you pick the best Forex liquidity provider out of all of them? And what should you be aware of?

Let’s look at the important red flags to look out for while looking for a liquidity partner in 2024:

There is No Information About Regulatory Compliance.

Working with a registered liquidity provider guarantees that they have met specific regulating body standards. This indicates they’ve been through rigorous screening and due diligence procedures to ensure their credibility and competency. It also protects businesses and traders since regulated providers are held accountable for their activities.

Before entering into a collaboration with a liquidity provider, it is critical to perform extensive research to ensure compliance with key rules in their country. Check to see if a firm has the necessary licenses and registrations to operate legally. Avoid suppliers who operate in areas with insufficient or non-existent restrictions, since this may expose you to unnecessary dangers.

Poor Feedback and a Bad Reputation

In the world of finance, reputation is everything. Whether you are searching for a supplier in cryptocurrency, equities, or the Forex market, you should carefully analyze their track record and client feedback. This is particularly true in Forex trading, where the risks are large and the market may be volatile.

A history of complaints is a major red signal when selecting a liquidity provider Forex. This might include recurring service quality concerns, order execution delays, or apathy when clients contact them. All of these are indications that the supplier may not be looking out for your best interests and may endanger your activities.

Hidden Fees and Unfair Restrictions

When it comes to selecting a liquidity provider, transparency is essential. Be wary of suppliers who charge hidden costs or have inappropriate terms and conditions. These hidden costs can have a substantial influence on your profitability and impair your capacity to manage your trading activity properly.

Before engaging into any partnerships, carefully evaluate the provider’s price structure and terms. Keep an eye out for execution regulations as well as any fines or costs related to transaction volumes. A good company should be upfront about their pricing and fully define all associated charges. Choose a provider that provides clear, simple pricing methods and conditions that correspond with your trading goals.

Inadequate Experience

When it comes to providing dependable and continuous liquidity services, experience may make all the difference. With years of expertise and a diverse customer base, experienced suppliers such as Leverate, Finalto, and B2Broker have most likely met and solved a variety of industry issues. This provides them with a distinct advantage in managing any stumbling blocks and assuring seamless operations for their clients.

Although newer suppliers may offer enticing price or creative solutions, their inability to efficiently navigate possible problems is a worry. Working with suppliers who have a demonstrated track record of providing dependable and regular liquidity services is often more smart.

Insufficient Security Measures

One of the key considerations when selecting a liquidity provider is the security of your traders’ assets. To guard against potential cyber attacks and other hazards, a respectable supplier should have strong security measures in place.

Examine whether a supplier has a history of security breaches or a lack of comprehensive security processes. Make certain you properly investigate the provider’s security measures and question their track record in protecting customer funds. To reduce the danger of potential losses, it is critical to work with a Forex liquidity provider that prioritizes security.

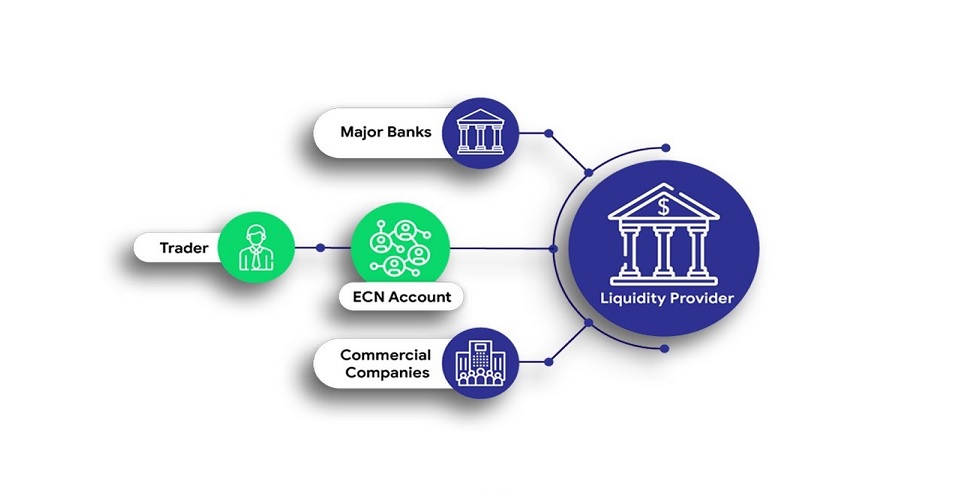

A respectable supplier should have links to numerous exchanges and marketplaces, allowing them to provide a wide variety of trading instruments as well as access to larger liquidity pools.

Check to see if the supplier can supply sufficient liquidity across numerous marketplaces and trading pairings. Examine the provider’s network, alliances, and product offerings.

There is no Effective Communication.

A respectable service should be open and honest about their operations, pricing models, and related dangers. They should give explicit documents and agreements outlining the partnership’s terms and conditions, leaving no space for ambiguity or misunderstanding.

Furthermore, Forex liquidity providers should offer competent and timely customer assistance to resolve any questions or problems raised by their clients as soon as possible. Delays or a lack of communication might be warning signs of future difficulties that could disrupt your business operations.

Solutions and Technology Are Limited.

Another critical factor to examine is the breadth of services and solutions provided by a liquidity provider. Reputable companies give a complete solution that meets all of your liquidity needs.

Compare the service packages supplied by the supplier to your expectations. Consider whether they provide the appropriate tools, such as various connection alternatives, thorough AML/KYC verification modules, and risk management capabilities. Be wary of vendors who have restricted offers or rigid solutions.

Refusal to Respond to Audit Requests

It might be a red indicator if a liquidity source exhibits resistance to due diligence or audit inquiries. It might point to possible problems such as poor financial health, a lack of transparency, or noncompliance with regulatory standards. The risks and legal complexity connected with collaborating with such suppliers are significant.

Final Claiming

When considering possible liquidity providers, remember to prioritize security, openness, and communication. Consider their track record, compliance initiatives, and the range of their offers and services.

Due investigation and selecting the correct liquidity source are key steps in establishing a successful trading firm. Take the time to examine your alternatives, consider the pros and disadvantages, and make an informed decision that meets your individual goals and objectives.